|

|

thanks, it looks like Robert Philipp's method suits my purpose. On Thu, Jul 28, 2011 at 11:05 PM, <[hidden email]> wrote:

Send QuantLib-users mailing list submissions to

[hidden email]

To subscribe or unsubscribe via the World Wide Web, visit

https://lists.sourceforge.net/lists/listinfo/quantlib-users

or, via email, send a message with subject or body 'help' to

[hidden email]

You can reach the person managing the list at

[hidden email]

When replying, please edit your Subject line so it is more specific

than "Re: Contents of QuantLib-users digest..."

Today's Topics:

1. way to shift curve (Shuo Wang)

2. Re: way to shift curve (Robert Philipp)

3. Quantlib with Python on Windows (Tiago Vieira)

4. Autocallable with trinomial tree (g m)

5. Re: way to shift curve (Bojan Nikolic)

6. QuantLib-SWIG 1.1 with Ruby 1.9 on Mac (Cyprian Kowalczyk)

7. TrinomialTree::descendant Usage (Smith, Dale)

---------- Forwarded message ----------

From: Shuo Wang <[hidden email]>

To: [hidden email]

Date: Sat, 23 Jul 2011 11:03:41 +0800

Subject: [Quantlib-users] way to shift curve

Hi,

I am very new to quantlib, may I know what is the easiest way to shift

a YieldTermStructure, at a key rate, say 5 year, up by 10bps?

--

Whatever your journey, keep walking.

---------- Forwarded message ----------

From: Robert Philipp <[hidden email]>

To: [hidden email]

Date: Sat, 23 Jul 2011 09:19:55 -0400

Subject: Re: [Quantlib-users] way to shift curve

Here is a code snippet to shock the entire curve. Just modify the spread vector to shock the points you like.

std::cout << "Shocking the term structure" << std::endl;

std::vector< Date > zeroDates( 180 );

std::vector< Handle< Quote> > spreads( 180 );

for( int t = 1; t < 2; ++t )

{

Date date = depoFutSwap->referenceDate() + Period( t, Months );

zeroDates.push_back( date );

spreads.push_back( Handle< Quote >( new SimpleQuote( 0.005 ) ) );

std::cout << date << std::endl;

}

std::cout << std::endl;

Handle< YieldTermStructure > depoFutSwapHandle( depoFutSwap, false );

PiecewiseZeroSpreadedTermStructure curve( depoFutSwapHandle, spreads, zeroDates );

std::cout << "Shocked Spot Rates and Forward Rates (Depo-Fut-Swap)" << std::endl;

for( Time t = 0; t < 180; ++t )

{

std::cout << t << ", " << curve.zeroRate( t / 12, Compounded ).rate()

<< ", " << curve.forwardRate( t/12, t/12, Compounded ).rate()

<< std::endl;

}

Robert Philipp

Synapse Financial Engineering

<a href="tel:703.623.4063" value="+17036234063" target="_blank">703.623.4063 (mobile)

<a href="tel:703.261.6799" value="+17032616799" target="_blank">703.261.6799 (fax)

[hidden email]

www.synapsefe.com

On 7/22/2011 11:03 PM, Shuo Wang wrote:

Hi,

I am very new to quantlib, may I know what is the easiest way to shift

a YieldTermStructure, at a key rate, say 5 year, up by 10bps?

---------- Forwarded message ----------

From: Tiago Vieira <tiagovieira.uk@googlemail.com>

To: [hidden email]

Date: Sun, 24 Jul 2011 16:19:21 +0100

Subject: [Quantlib-users] Quantlib with Python on Windows

Hello all

I had some troubles to have my Windows machine configured to use QuantLib through Python. Mac and Linux is quite a quick configuration, but on Windows with MinGW it was a big journey. I didn't want to use Microsoft Visual Studio to get involved in this process at all and as I use MinGW and EPD, I wanted to keep everything into this environment. So, after almost 2 days fighting, I got that working. So, I then created a tutorial which I believe can save the time for those who wants to achieve the same thing.

If you want to have a look, the link is: http://bit.ly/oG6HiQ

If you think there are a better compiler configuration (settings, variables, definitions, etc), I would be happy if you can share so then I update the post or redirect to your blog if you have one. If you have any question, few free to contact me in private. It worked on Windows XP and Windows Vista. Not sure if it will be the same as Windows 7.

Cheers,

Tiago

---------- Forwarded message ----------

From: g m <[hidden email]>

To: <[hidden email]>

Date: Tue, 26 Jul 2011 10:40:20 +0200

Subject: [Quantlib-users] Autocallable with trinomial tree

Hi all,

I'd like to price an autocallable on equity with conditional coupons, I checked the code for callable bond in ordre to get some ideas and I wonder if I can

use a trinomial tree scheme combined with an equity model.

Thank you for your help!

---------- Forwarded message ----------

From: Bojan Nikolic <[hidden email]>

To: [hidden email]

Date: Tue, 26 Jul 2011 10:08:27 +0100

Subject: Re: [Quantlib-users] way to shift curve

Depending on what you are trying to do, you may want to bump the

rate/price of one or more market observables and then re-build the

curve. In this way you can, for example, work out how well your hedges

in the liquid market instruments used that are used to build the curve

protect your illiquid portfolio that you are trying to value. This is

very easy to as all you need to do is bump the input data by required

amount and the curve is automatically rebuilt. I've posted a simple

example here:

http://www.bnikolic.co.uk/blog/ql-bumping-curve.html

--

Bojan Nikolic || http://www.bnikolic.co.uk

---------- Forwarded message ----------

From: Cyprian Kowalczyk <[hidden email]>

To: [hidden email]

Date: Thu, 28 Jul 2011 14:12:45 +0200

Subject: [Quantlib-users] QuantLib-SWIG 1.1 with Ruby 1.9 on Mac

Hello,

I am trying to make QuantLib working with Ruby 1.9 via SWIG.

I have QuantLib and SWIG installed and now trying to install QuantLib-SWIG 1.1. First I had problem with 'ftools' as it's depreciated in Ruby 1.9 - I used 'fileutils' instead but I get the following error while running 'ruby setup.rb build':

/usr/local/Cellar/quantlib/1.1/include/ql/methods/finitedifferences/finitedifferencemodel.hpp:109: warning: implicit conversion shortens 64-bit value into a 32-bit value

make: *** [quantlib_wrap.o] Error 1

Any hints on whether it's possible at all to make QuantLib talking with Ruby?

Thanks, Cyprian

---------- Forwarded message ----------

From: "Smith, Dale" <[hidden email]>

To: <[hidden email]>

Date: Thu, 28 Jul 2011 10:07:35 -0500

Subject: [Quantlib-users] TrinomialTree::descendant Usage

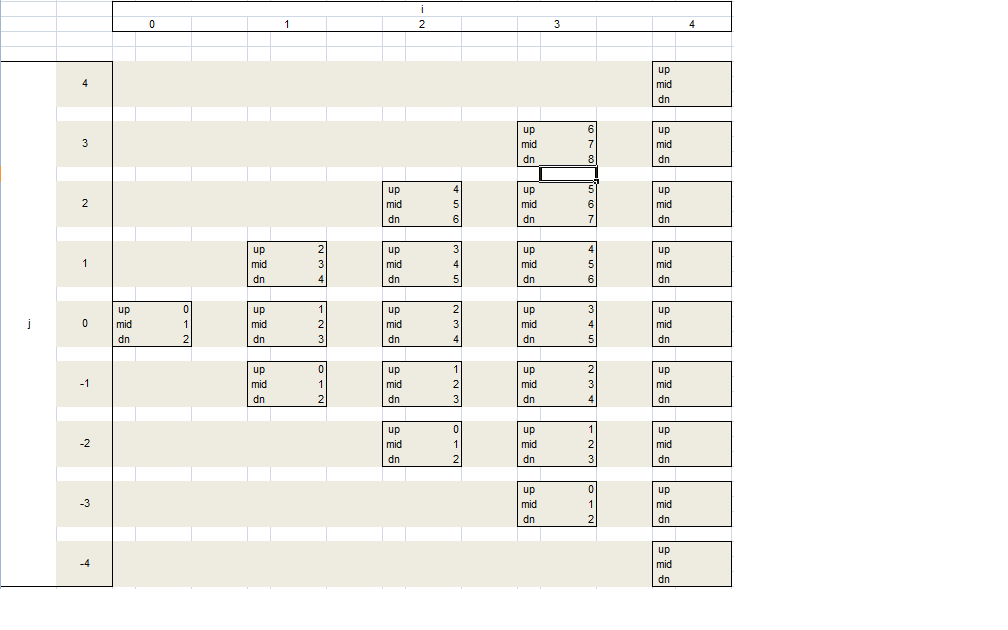

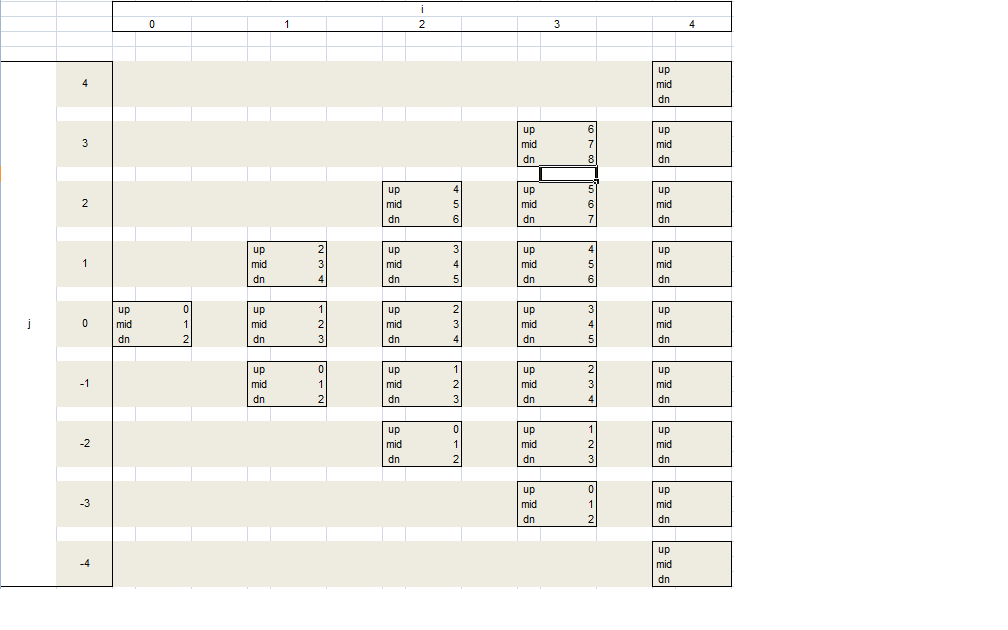

Hello,

I’ve looked at the implementation of TrinomialTree and

have a question about TrinomialTree::descendant. I’m assuming the tree

looks like the enclosed. I filled in the value of descendent(I,j,branch)

(branch = 0, 1, or 2).

What does descendent mean in this case? I did read the code,

made a copy of it and put in some print statements to see what’s

happening. I’m not able to determine how descendant is used. I’ve

also looked at TreeLattice<Impl>::stepback. In this method, descendant

would be the index into values, which I assume holds prices of the instrument

valued. However, this doesn’t give much light for me.

My goal is to implement a Hull-White tree with the discrete

alpha calculation, instead of the continuous-time implementation in the

HullWhite class. HullWhite gives values close to those of the example in their

1994 paper, but it’s not quite the same.

Thanks,

Dale Smith, Ph.D.

Senior Financial Quantitative Analyst

Risk & Compliance

Fiserv.

107 Technology Park

Norcross, GA 30092

Office: <a href="tel:678-375-5315" value="+16783755315" target="_blank">678-375-5315

Mobile: <a href="tel:678-982-6599" value="+16789826599" target="_blank">678-982-6599

Mail: [hidden email]

www.fiserv.com

------------------------------------------------------------------------------

Got Input? Slashdot Needs You.

Take our quick survey online. Come on, we don't ask for help often.

Plus, you'll get a chance to win $100 to spend on ThinkGeek.

http://p.sf.net/sfu/slashdot-survey

_______________________________________________

QuantLib-users mailing list

[hidden email]

https://lists.sourceforge.net/lists/listinfo/quantlib-users

-- 王硕 邮箱: [hidden email]手机:18601145517 Whatever your journey, keep walking.

------------------------------------------------------------------------------

BlackBerry® DevCon Americas, Oct. 18-20, San Francisco, CA

The must-attend event for mobile developers. Connect with experts.

Get tools for creating Super Apps. See the latest technologies.

Sessions, hands-on labs, demos & much more. Register early & save!

http://p.sf.net/sfu/rim-blackberry-1_______________________________________________

QuantLib-users mailing list

[hidden email]

https://lists.sourceforge.net/lists/listinfo/quantlib-users

|