Smooth Forward Curve from Market Rates

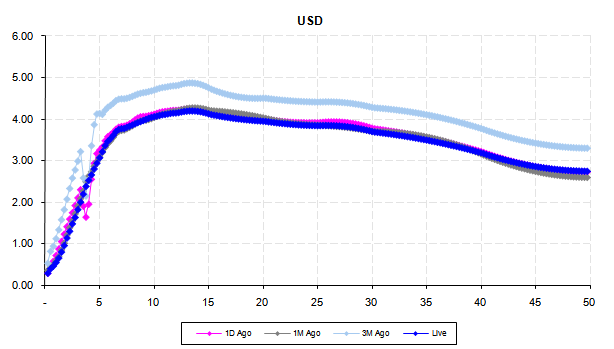

I have attached a screenshot of the 3 month forwards implied by current market quotes using the Piecewise Bootstrapped Term Structure - the resulting curve, as you can see, is not smooth at all. Is it possible to get the market implied forwards with a smooth interpolation? Note the smooth-usd.png file - is something like this possible using QuantLib and actual market rates? Further - notice the tail end of the two curves, the QL term structure is implying forwards of > 3.5% past the 40 year point where the actual market forwards are just under 3%. This is clearly inaccurate if one were to trade a long-dated forward swap. |

Re: Smooth Forward Curve from Market Rates

|

On Wed, 2010-09-15 at 06:45 -0700, newbie730 wrote:

> http://old.nabble.com/file/p29718645/USD%2B9-15-2010.png > http://old.nabble.com/file/p29718645/smooth-usd.png > I have attached a screenshot of the 3 month forwards implied by current > market quotes using the Piecewise Bootstrapped Term Structure - the > resulting curve, as you can see, is not smooth at all. Is it possible to get > the market implied forwards with a smooth interpolation? Luis, what interpolation are you using, and on what? (discounts, forwards, zeroes?) With what template arguments are you instantiating the piecewise curve? > Further - notice the tail end of the two curves, the QL term structure is > implying forwards of > 3.5% past the 40 year point where the actual market > forwards are just under 3%. This is clearly inaccurate if one were to trade > a long-dated forward swap. Hmm. What data are you using? Luigi -- Better to remain silent and be thought a fool than to speak out and remove all doubt. -- Abraham Lincoln ------------------------------------------------------------------------------ Start uncovering the many advantages of virtual appliances and start using them to simplify application deployment and accelerate your shift to cloud computing. http://p.sf.net/sfu/novell-sfdev2dev _______________________________________________ QuantLib-users mailing list [hidden email] https://lists.sourceforge.net/lists/listinfo/quantlib-users |

|

Luis,

what interpolation are you using, and on what? (discounts, forwards, zeroes?) With what template arguments are you instantiating the piecewise curve? -- LogLinear interpolation on the discount rate > Further - notice the tail end of the two curves, the QL term structure is > implying forwards of > 3.5% past the 40 year point where the actual market > forwards are just under 3%. This is clearly inaccurate if one were to trade > a long-dated forward swap. Hmm. What data are you using? -- both curves were created using the same data from Bloomberg, which is a combination of the deposit rates, futures and swap rates out to 50 yrs Luigi -- Better to remain silent and be thought a fool than to speak out and remove all doubt. -- Abraham Lincoln ------------------------------------------------------------------------------ Start uncovering the many advantages of virtual appliances and start using them to simplify application deployment and accelerate your shift to cloud computing. http://p.sf.net/sfu/novell-sfdev2dev _______________________________________________ QuantLib-users mailing list QuantLib-users@lists.sourceforge.net https://lists.sourceforge.net/lists/listinfo/quantlib-users |

|

In reply to this post by newbie730

Switch your interpolation to "MonotonicLogCubicNaturalSpline" on Discount Factors, that will smooth out your curve.

The actual 3m forward rates out in the super-long end of the curve are not under 3%. 3m forward Libor rates around the 37 year point are roughly 3.55%, so wherever you are referencing, your data is incorrect. -Mike On Wed, Sep 15, 2010 at 8:45 AM, newbie730 <[hidden email]> wrote:

------------------------------------------------------------------------------ Start uncovering the many advantages of virtual appliances and start using them to simplify application deployment and accelerate your shift to cloud computing. http://p.sf.net/sfu/novell-sfdev2dev _______________________________________________ QuantLib-users mailing list [hidden email] https://lists.sourceforge.net/lists/listinfo/quantlib-users |

Re: Smooth Forward Curve from Market Rates

|

Thanks for the tip on using the MonotonicLogCubicNaturalSpline - this provides a smooth curve as I was expecting. Regarding the forward rates, QL is showing about 3.56 and Bloomberg is about 3.55, so perhaps there is another error showing up with the comparison curve stripper. Where can I find a listing of the different types of interpolation schemes available on what data they can be used?

Thanks for the help!

On Thu, Sep 16, 2010 at 1:25 PM, Mike DelMedico <[hidden email]> wrote: Switch your interpolation to "MonotonicLogCubicNaturalSpline" on Discount Factors, that will smooth out your curve. ------------------------------------------------------------------------------ Start uncovering the many advantages of virtual appliances and start using them to simplify application deployment and accelerate your shift to cloud computing. http://p.sf.net/sfu/novell-sfdev2dev _______________________________________________ QuantLib-users mailing list [hidden email] https://lists.sourceforge.net/lists/listinfo/quantlib-users |

QuantLibAddin::Token::Interpolator

QuantLibAddin::Token::Traits

On Thu, Sep 16, 2010 at 12:51 PM, luis cota <[hidden email]> wrote:

------------------------------------------------------------------------------ Start uncovering the many advantages of virtual appliances and start using them to simplify application deployment and accelerate your shift to cloud computing. http://p.sf.net/sfu/novell-sfdev2dev _______________________________________________ QuantLib-users mailing list [hidden email] https://lists.sourceforge.net/lists/listinfo/quantlib-users |

Re: Smooth Forward Curve from Market Rates

|

> On Thu, Sep 16, 2010 at 12:51 PM, luis cota <lo.maximo73 <at> gmail.com>

wrote: > Thanks for the tip on using the MonotonicLogCubicNaturalSpline - this provides a smooth curve as I was expecting. Regarding the forward rates, QL is showing about 3.56 and Bloomberg is about 3.55, so perhaps there is another error showing up with the comparison curve stripper. Where can I find a listing of the different types of interpolation schemes available on what data they can be used? Perhaps this paper could be of interest: http://www.finmod.co.za/Hagan_West_curves_AMF.pdf Br, Nicolai ------------------------------------------------------------------------------ Start uncovering the many advantages of virtual appliances and start using them to simplify application deployment and accelerate your shift to cloud computing. http://p.sf.net/sfu/novell-sfdev2dev _______________________________________________ QuantLib-users mailing list [hidden email] https://lists.sourceforge.net/lists/listinfo/quantlib-users |

«

Return to quantlib-users

|

1 view|%1 views

| Free forum by Nabble | Edit this page |