Variance Swap test

|

This post was updated on .

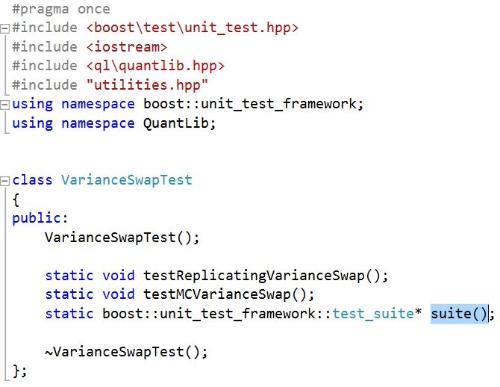

I was looking at the VarianceSwap example in test-suite. In Visual Studio 2015, I created a class called VarianceSwapTest, and call it from the main() function.

I notice that the testing functions testReplicatingVarianceSwap() and testMCVarianceSwap() are both called by the other function static boost::unit_test_framework::test_suite* suite().  Since the return type is test_suite*, I'm wondering how to fill in the main() function to call it, and what kind of results shall I expect, from Visual Studio 2015? Thanks! |

|

This post was updated on .

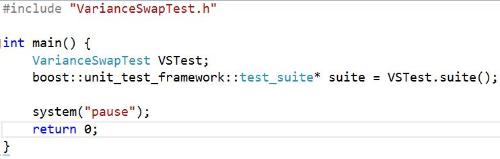

BTW, if I "directly call" the suite() function in main() this way:

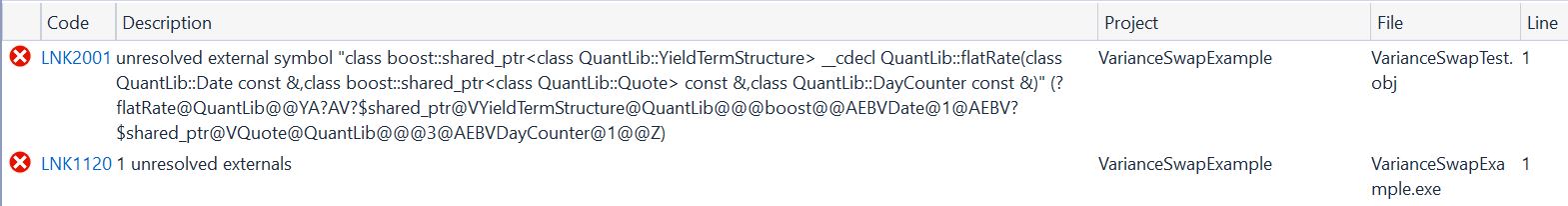

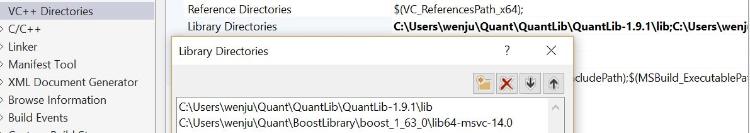

I got 2 errors while compiling:  This is how to link boost library and quantlib for this project:   Could anyone please advise how to fix, perhaps add some modification on the Linker part in Visual Studio? |

|

The main() function using the suite is provided by the Boost unit-test framework; you'll need to provide an init_unit_test_suite function, as done in the quantlibtestsuite.cpp file. As for the linking errors you were getting: flatRate is defined in test-suite/utilities.cpp, and you need to link it together with your other files. Luigi On Tue, Feb 7, 2017 at 5:35 PM ziegele <[hidden email]> wrote: BTW, if I "directly call" the suite() function in main() this way: ------------------------------------------------------------------------------ Check out the vibrant tech community on one of the world's most engaging tech sites, SlashDot.org! http://sdm.link/slashdot _______________________________________________ QuantLib-users mailing list [hidden email] https://lists.sourceforge.net/lists/listinfo/quantlib-users |

|

Thanks Luigi!

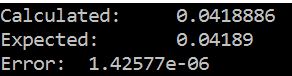

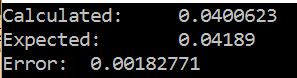

I bypassed the problem by replacing flatRate() as defined in utilities.hpp with the FlatForward class. As shown in the screenshot below, the calculation matches with expected result very well. I also included the cpp codes in attachment (flat.cpp).  Naturally, the next step is to replace flat interest rate and dividend with a term structure. So I tried the InterpolatedZeroCurve class. In order to make sure that I get this class setup correctly, I defined a flat interest rate terms structure, to compare with the FlatForward results. The code is also attached (termStructure.cpp). Unfortunately, the calculation result didn't match with expectation:  My guess is that, building flat forward curve from a flat interest rate term structure should use some other functions. How should I correctly interpolate the term structure, so that I can: 1) match with the constant div and r at the first step; 2) introduce non-flat interest rate and dividend term structure? Thanks! |

|

The difference might be that in the flat forward case your curve starts at today's date, while in the interpolated case it starts at February 24th and the discount factors used in the calculation will change accordingly. You should try using today as the first date in the vector instead.

Luigi On Wed, Mar 1, 2017 at 4:04 AM ziegele <[hidden email]> wrote: Thanks Luigi! ------------------------------------------------------------------------------ Check out the vibrant tech community on one of the world's most engaging tech sites, Slashdot.org! http://sdm.link/slashdot _______________________________________________ QuantLib-users mailing list [hidden email] https://lists.sourceforge.net/lists/listinfo/quantlib-users |

|

This post was updated on .

Thanks Luigi.

I tried to expand the variance swap replication example to include: non-flat volatility surface, non-flat interest rate, and non-flat discrete dividend term structure, based on the example I could find from Mick Hittesdorf's tutorial at https://mhittesdorf.wordpress.com/2013/11/17/introducing-quantlib-american-option-pricing-with-dividends/ As you can find in the attached file main.cpp, I used boost::shared_ptr<ZeroCurve> to generate the discrete dividend term structure, and boost::shared_ptr<YieldTermStructure> with InterpolatedZeroCurve<ForwardFlat> to return the interest rate term structure. There are some things that I'm not sure if I did correctly: 1. How do I include discrete dividend, rather than dividend yield, into the calculation? Currently I translated discreteDiv to divYield by the equation: divYield = discreteDiv / spot * yearFraction(evaluationDate, optionExpiryDate), for each exDividend date (data read from dividend_schedule.csv file). Is it correct? 2. How do I correctly interpolate the interest rate term structure? (1) Currently I used a flat interest rate of 5% (read from ir_schedule.csv file, with the 1st dividend date to be the evaluationDate, otherwise PV would be wrong). Is there a way of inputting discount factor directly? If so, how do I change InterpolatedZeroCurve() to? (2) Do I really need the <ForwardFlat> selection to interpolate the interest rate? If not, what are other choices? 3. What is the difference between <ZeroCurve> used in dividend, and <YieldTermStructure> used in interest rate term structure? Loos to be that I could also use one to replace the other; 4. Currently the volatility surface is kept the same as what's written in the example (vol=0.3~0.13, linearly dependent on strike). If I want to include a full volatility surface which can also be read from a file, can I keep the codes unchanged (lines 15-45)? 5. The size of dK impacts PV. Currently I chose dK=2.5 because it matches with calculation results from Numerix. But how do I know if dK is correctly chosen? Shouldn't PV be irrelevant to dK, in theory? Thanks, ziegele |

|

Hello, 1. yes, you'll have to translate discrete dividends into dividend yields. I'm not sure of the times you're using, though. If an option expires in 6 months and you expect a dividend in 2 months, do you divide by 6 or 2? Do you spread next dividend starting from today or from the first dividend date? (The two answers might be correlated.) 2. You can use InterpolateDiscountCurve and build it from discounts. There are a number of interpolations available; look into ql/math/interpolations for classes documented as "traits". 3. ZeroCurve is a particular kind of YieldTermStructure. 4. I'm not sure I got your question... Luigi On Fri, May 12, 2017 at 11:21 PM ziegele <[hidden email]> wrote: Thanks Luigi. ------------------------------------------------------------------------------ Check out the vibrant tech community on one of the world's most engaging tech sites, Slashdot.org! http://sdm.link/slashdot _______________________________________________ QuantLib-users mailing list [hidden email] https://lists.sourceforge.net/lists/listinfo/quantlib-users |

«

Return to quantlib-users

|

1 view|%1 views

| Free forum by Nabble | Edit this page |