Re: Modifying FittedBondDiscountCurve - 1st Mystery

Posted by Allen Kuo-2 on

URL: http://quantlib.414.s1.nabble.com/Re-Modifying-FittedBondDiscountCurve-1st-Mystery-tp15577p15578.html

------------------------------------------------------------------------------

Open source business process management suite built on Java and Eclipse

Turn processes into business applications with Bonita BPM Community Edition

Quickly connect people, data, and systems into organized workflows

Winner of BOSSIE, CODIE, OW2 and Gartner awards

http://p.sf.net/sfu/Bonitasoft

_______________________________________________

QuantLib-users mailing list

[hidden email]

https://lists.sourceforge.net/lists/listinfo/quantlib-users

URL: http://quantlib.414.s1.nabble.com/Re-Modifying-FittedBondDiscountCurve-1st-Mystery-tp15577p15578.html

Hi Nick :

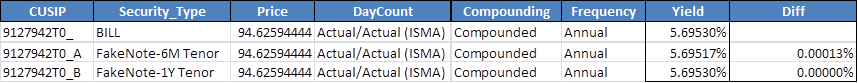

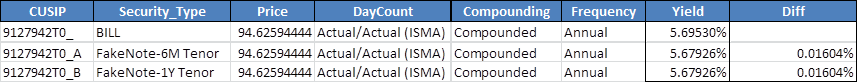

1. Note the yield to maturities for each bond, calculated by hand, but assuming slight number

of difference in days as the tenors (which I define as "remaining maturity") :

yield to maturity tenor (days)

5.69530% 364 [date diff between 8/22/1996 and 8/21/1997]

5.67926% 365

5.66331% 366

2. Tho I don't have excel addin installed or any of the latest quantlib versions, in your excel addin,

I see you specified both maturity date and "tenor" (6M or 1Y). Though you can construct a bond's cash flows

using either, see if you can leave out the "tenor" and to get the excel addin to give you a response just

based on the maturity date you input. This will reduce the number of variables we are looking at. It could be

that because you specified a 1Y tenor for your "fake" bill, QuantLib 1.4.0/VS2010 assumed the tenor was

exactly one year, and thus gave you the 5.67926% response above. For your real zero coupon bond, appears

you only specified the exact maturity date, and are thus getting the the 5.69530% number above.

3. This doesn't explain the Github / VS 2012 results but lets take it a step at a time. I don't understand

the "6M tenor" fake bond- no real need to test with that bond either, because if the tenor (defining

tenor as "remaining maturity") were 6M, the yield to maturity would be very different than your real zero

coupon bond of tenor 1Y (remaining maturity), assuming both have the same prices. Or I just don't understand

"tenor" in Excel add-in....

Allen

1. Note the yield to maturities for each bond, calculated by hand, but assuming slight number

of difference in days as the tenors (which I define as "remaining maturity") :

yield to maturity tenor (days)

5.69530% 364 [date diff between 8/22/1996 and 8/21/1997]

5.67926% 365

5.66331% 366

2. Tho I don't have excel addin installed or any of the latest quantlib versions, in your excel addin,

I see you specified both maturity date and "tenor" (6M or 1Y). Though you can construct a bond's cash flows

using either, see if you can leave out the "tenor" and to get the excel addin to give you a response just

based on the maturity date you input. This will reduce the number of variables we are looking at. It could be

that because you specified a 1Y tenor for your "fake" bill, QuantLib 1.4.0/VS2010 assumed the tenor was

exactly one year, and thus gave you the 5.67926% response above. For your real zero coupon bond, appears

you only specified the exact maturity date, and are thus getting the the 5.69530% number above.

3. This doesn't explain the Github / VS 2012 results but lets take it a step at a time. I don't understand

the "6M tenor" fake bond- no real need to test with that bond either, because if the tenor (defining

tenor as "remaining maturity") were 6M, the yield to maturity would be very different than your real zero

coupon bond of tenor 1Y (remaining maturity), assuming both have the same prices. Or I just don't understand

"tenor" in Excel add-in....

Allen

------------------------------------------------------------------------------

Open source business process management suite built on Java and Eclipse

Turn processes into business applications with Bonita BPM Community Edition

Quickly connect people, data, and systems into organized workflows

Winner of BOSSIE, CODIE, OW2 and Gartner awards

http://p.sf.net/sfu/Bonitasoft

_______________________________________________

QuantLib-users mailing list

[hidden email]

https://lists.sourceforge.net/lists/listinfo/quantlib-users

| Free forum by Nabble | Edit this page |